https://stagprotect.com/wp-content/uploads/2021/06/toa-heftiba-nrSzRUWqmoI-unsplash.jpg

427

640

B4t5r0ck

https://stagprotect.com/wp-content/uploads/2019/02/StagProtectLogo3_Light.png

B4t5r0ck2021-06-14 13:15:412021-06-14 13:19:05What is Forces Help to Buy and how does it work

https://stagprotect.com/wp-content/uploads/2021/06/toa-heftiba-nrSzRUWqmoI-unsplash.jpg

427

640

B4t5r0ck

https://stagprotect.com/wp-content/uploads/2019/02/StagProtectLogo3_Light.png

B4t5r0ck2021-06-14 13:15:412021-06-14 13:19:05What is Forces Help to Buy and how does it work

Your home is probably the largest investment you will make; not only in terms of money, but also the time you invest in the process.

Your home is also where you spend a large amount of your time. You want it to suit your needs, be safe, comfortable and be something you can be proud of.

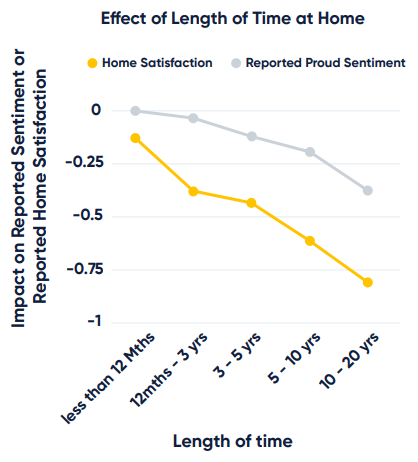

Unfortunately, if you get it wrong your satisfaction can quickly drop. In the Science of a Happy Home, homeowner architects Resi identify that most people become less satisfied with their home over time:

When you buy your home, you want to make sure that your home keeps satisfying you and your family for years to come.

Buying a home can be overwhelming as there are so many choices you must make. But some of the choices matter more than others.

In this blog we explain why you should buy with your head and not your heart, and then give you our top tips to get your perfect home.

Why not to buy with your heart

You have seen the perfect home and you instantly fall in love with it. It’s perfect. It looks beautiful. It’s in a small quiet village, it’s got a large garden with a small stream, it’s got a wonky door you must duck through. The family living there have been so happy in it. Your heart says, “let’s buy it!” Your head isn’t sure, but your heart wins.

When you move in you slowly realise it’s not so perfect after all:

- It’s a long way from work/school/shops

- You don’t like gardening

- And to top it off, ducking through the door drives you mad.

Your head was right. You should have bought with your head and not your heart.

Use your head to get your perfect home

Emotions change. Just think about that embarrassing crush that you now laugh about.

When it comes to buying a home, your emotions can lead you to buy with your heart and make a bad decision for the long term. Whereas buying with your head can lead to the perfect house.

Here are our top tips to get the perfect house.

1. The seller’s dream is not your dream

You and your family are unique. Your needs are specific to you. The seller’s family may have lived a happy life in the house, but that’s not your family. Someone else’s perfect home is not your perfect home.

When you visit a house it’s easy to forget your dream and instead buy the seller’s dream.

To stop this happening, use our Home Needs Checklist. It will take you 5minutes to complete and at the end you will know what your dream is.

2. Budget

That house may be perfect, but if it’s outside your budget, you will pay in more ways than one. With your finances tight, you will have to cut back on other parts of your life. When you are missing the other things you like to do in life, the perfect house can become an expensive chain around your neck.

Before you start looking for houses, make sure you have sorted your budget.

When you heart says ”we can afford it”, let your head say “but it won’t make us happy”.

3. Focus on use not looks

Think how quickly you stop noticing how things look. That moment when you ask, “when did that change?” and you’re shocked that you didn’t notice.

Instead think about how you use your home. What do you need to be able to do? Make sure the house fits your needs, so your satisfaction with it doesn’t drop.

Yes, the house may look beautiful, but you will quickly stop noticing. Whereas how you use it will stay forever.

4. Location

Location is everything when it comes to homes. If you need to be near shops, schools or work then this should be your priority over how the house looks.

It may be your dream house, but the extra 30 minutes on your commute may make it a nightmare.

5. Compromising on the wrong thing

When buying a home you are going to have to compromise, so make sure you compromise on the right things.

That house you just saw may have all the things you would like, but if it doesn’t have the things you need then it’s not perfect. It’s easy to think 10 ‘nice to haves’ will make up for not having the things you need, but once you move in you will be disappointed. If you need a garage to store your family bikes, then the wood burner won’t make up for it.

Your house must fulfil your needs and everything else is a bonus.

Our Home Buyers Checklist will help you work out what your home needs to have.

6. Renovations

You’ve found a home you like, but you think the kitchen needs renovating or it needs redecorating. It may not appear to be a lot of work. You may even think you can do it yourself. That’s all well and good, but the costs soon add up and will you have time to do it? Whilst your heart is jumping in, allow you head the time to think about what’s involved and understand the full costs and consequences.

7. Quirky

Quirky buildings can be beautiful and interesting, but remember what is fun now can quickly turn into a chore. A town house might appear fun but you might end up screaming when trying to carry the shopping and the baby up the stairs.

Also, buildings of unusual construction can be difficult and expensive to maintain and insure. The decision to buy the thatched cottage may cost you money every year.

8. Listed buildings

Listed buildings are usually beautiful and interesting but come with their own drawbacks. Buildings are listed because they are of historical importance. This means they are to be preserved as they are. If you want to do any work on a listed building (even quite minor work) you need to apply to the council for consent.

This can limit how you use the building: for example, you might not be able to add an en-suite bathroom or install double glazing.

If you find a listed building that meets your needs, make sure you factor in the additional costs.

What you should do now

Download our Home Buyers Checklist to help you understand your dream house.

Our next blogs in this series will cover topics including how to review the property market, how to view a property, how to pick a solicitor and how to protect your family. Follow us on Facebook and LinkedIn to make sure you don’t miss out.

Share this article

Mortgages:

Batsrock Limited, trading as Stag Protect, acts as an intermediary for the purposes of introducing its customers to Yes Mortgage Services Limited, part of the H L Partnership.

YES Mortgage Services Limited is an appointed representative of H L Partnership Limited which is authorised and regulated by the Financial Conduct Authority. YES Mortgages Services Limited is a company registered in England and Wales with company number 08872874. The registered office address is Yes Mortgage Services Limited, Four Winds, 22 Windmill Lane, Avon Castle, Ringwood, Hampshire, BH24 2DQ.

You will not receive advice or any recommendation from Batsrock Financial. Such services will be provided by Yes Mortgage Services Limited.

More in this series

https://stagprotect.com/wp-content/uploads/2021/06/toa-heftiba-nrSzRUWqmoI-unsplash.jpg

427

640

B4t5r0ck

https://stagprotect.com/wp-content/uploads/2019/02/StagProtectLogo3_Light.png

B4t5r0ck2021-06-14 13:15:412021-06-14 13:19:05What is Forces Help to Buy and how does it work

https://stagprotect.com/wp-content/uploads/2021/06/toa-heftiba-nrSzRUWqmoI-unsplash.jpg

427

640

B4t5r0ck

https://stagprotect.com/wp-content/uploads/2019/02/StagProtectLogo3_Light.png

B4t5r0ck2021-06-14 13:15:412021-06-14 13:19:05What is Forces Help to Buy and how does it work

13 things to remember after you’ve moved into your new home

How to protect your home and family

Picking a solicitor

How to negotiate

What’s the difference between leasehold and freehold?

Understanding mortgages

The process of buying a property in 2021

Reviewing the housing market in 2021

How to view a property

Should you buy a house with your head or your heart?

Demystifying home buying terms

Home buyers checklist

https://stagprotect.com/wp-content/uploads/2020/12/andrew-mead-r_X4YHAlBPo-unsplash.jpg

1280

1920

Stuart Andrews

https://stagprotect.com/wp-content/uploads/2019/02/StagProtectLogo3_Light.png

Stuart Andrews2020-12-22 21:52:212021-03-04 19:17:19is buying a new home in 2021 a good New Year resolution?

https://stagprotect.com/wp-content/uploads/2020/12/andrew-mead-r_X4YHAlBPo-unsplash.jpg

1280

1920

Stuart Andrews

https://stagprotect.com/wp-content/uploads/2019/02/StagProtectLogo3_Light.png

Stuart Andrews2020-12-22 21:52:212021-03-04 19:17:19is buying a new home in 2021 a good New Year resolution?Regulatory Details

Stag Protect is a trading style of Batsrock Financial Ltd (company number 11755118) which is an Appointed Representative of Andrews Risk Consulting. Andrews Risk Consulting is a trading style of Stuart Andrews who is authorised and regulated by the Financial Conduct Authority (FCA Number: 820518)

Important Info

Contains public sector information licensed under the Open Government Licence v3.0.

© Copyright – Stag Protect

Our Contact Info

03333 447 472

Info@Stagprotect.com

21-22 Bath St, Frome, BA11 1DJ